COVID is OVER! According to my rapidly booming AirBnb income…

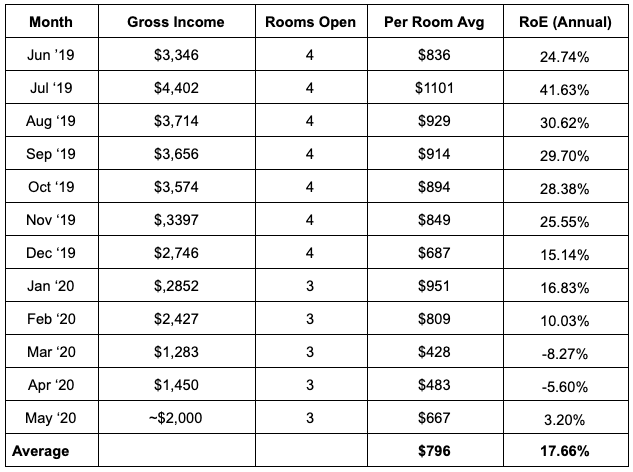

The two most common AirBnb questions I get: How much do you make? How is COVID impacting business? Well, here you go — pure factual numbers.

- How much do you make on your AirBnb?

- How is COVID impacting it?

Like discussing salaries, you can’t help one another without sharing real data. So, I’ll just give you real numbers — it’s easier that way.

Super fast background.

My wife and I have a goal of buying a property once a year. We use different rental strategies: some properties are for short-term rentals (like AirBnb), and others are for long-term rentals that come with a lease or contract.

The metric we use to measure how well we are financially doing with all our properties, regardless of the rental strategy, is Return on Equity. We like to go in with as little as possible, I.E. have as little equity as possible, and maximize our income and ultimately our return on the equity we have stuck in the property.

For example, one of our properties is valued at about $400,000. We gross around $42,500/Y in AirBnB income on it. Let’s say I bought the house in cash (which we didn’t). My net income would be the $42,500 minus all our expenses — taxes, insurance, utilities, and misc items… about $3,500 — which leaves $39,000. If I bought the house in cash, I’d have $400K in equity, or in other words, I would have had to tie up $400,000 to make that $39,000 per year. That’s a 9.75% annual return. Pretty amazing.

However, my wife and I put minimal down on the house and only have about $75,000 in equity today. Yes, that forces our net income a bit lower — about $15,000 lower — because of interest payments. Now we net about $24,000/Y. However, in this case, we only had to tie up $75,000 to make that $24,000, or a 32% return!

We love looking at our real estate investments this way. We used to manage it ourselves, now we just use WayBoz — 100 times easier.

Now let’s look at our real numbers over the past year.

For simplicity, assume our total monthly expenses (not including principal payments) are about $1,800 (interest, PMI, taxes, insurance, utilities, misc) and our total equity is $75,000. Side note, we are living in some of the units as well. It is a 6 bed 4 bath house. In January we moved to only renting out three rooms instead of the four we were previously doing (a family member moved in with us).

Since rental rates vary across the country (e.g., In Utah, where our example property is located, a room would rent for 400–500/m with a year lease), focusing on RoE somewhat standardizes the data.

Now, let’s see how things went during the past year and how COVID impacted one of our properties.

- Most obvious, our short-term rental bring in almost twice what a long-term rental would ($400 vs $800/M). Even during COVID, it only dropped to what a long-term rental would have been.

- Looking at the per room average there was an expected large dip during COVID — around 50% lower than what we were averaging prior (frankly, I’m surprised it didn’t dip more). However, in May we were only down about 25%. Also, our entire July is already 100% booked. Are my AirBnb bookings saying the COVID craziness is over?

- Per door is important. Previously we were renting out 4 rooms and then switched to 3. We reduced our income by 25% which dropped our ROE percentage from the high 20s to the mid teens — a huge drop!

- Even in the months where we had a negative RoE we have to remember we are living in the house at the same time! If we were to move out and have six doors all bringing in the same ~$900/door (assumes no COVID), our ROE would be 57.6%! Yes, we are doing that soon…

So, there you have it…

I could get into strategies about how to better leverage equity and repurpose it across multiple properties to increase your return, etc etc, but honestly, like I said above, I just use WayBoz for that. So even during a crazy, unparalleled, economic disaster we were still able to have a 17.6% return on the equity we have in our property over the last 12 months… while living in the house basically for free. Not bad.

What were your real estate investing strategies during COVID?

What issues did you have?

How did you address them?

Has COVID changed how you approach real estate investing?

Comment below and let us know!

Also, you might be wondering when or if we use other ROI metrics like Cash on Cash Return

or Cap Rate. Check out our blog to see the articles we've written.

Don't forget to sign up below!