Our exact 2020 earnings AirBnbing our house… and the impact COVID had (or actually didn’t have)

If you’re curious to how much you can make with short-term rentals, here you go. Real numbers, profitability calculations, and more… all during a wild 2020.

The feedback I get most often from my posts: “I love that you use real numbers and aren’t shy sharing your personal successes (or failures).”

Well, in that spirit, let’s look at exactly how one of our properties performed in dreaded 2020.

As a quick background, we love having our properties be short-term rentals (like AirBnb). We do have long-term renters in some of our properties, but AirBnb is just so much more profitable (you’ll see later in this post) that we always try to do short-term instead of long-term rentals where possible.

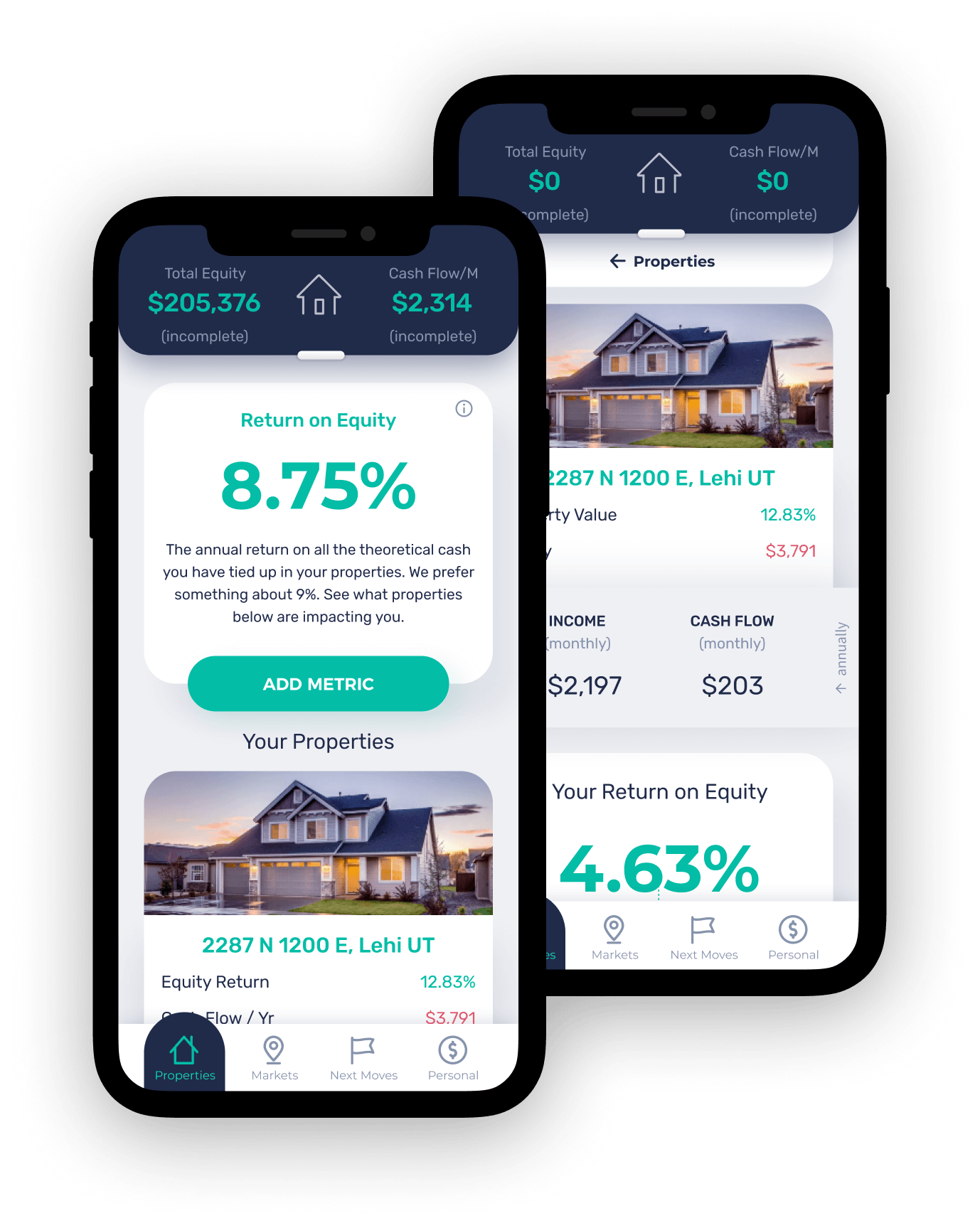

Also, if you are wondering how I know all the below data we’re about to discuss, it’s easy: I use WayBoz. That’s why we built it. It shows you exactly how well your properties are performing and even helps you optimize them. Ditch the spreadsheets, get WayBoz.

Finally, to make everything we are about to cover below super tangible for you, we’ll look at the house that my wife and I actually live in (not one of investment properties), so it’s something you could do too in your house.

That being said… let’s talk about how our 2020 as an AirBnb host went.

First, the house.

The house we currently live in we bought in 2018. It’s a rambler with a basement, and the house is only about 2,600 square feet.

When we bought it, it was a 5 bed 3 bath. The main floor had 3 beds and 2 baths and the other 2/1 were in the basement.

After about a month of owning the house, we accidentally flooded the laundry room, which led to us ripping up some nearby, nasty old carpet that got wet…

… and then we started breaking other stuff…

… and then quickly escalated to us destroying the house.

However, my wife and I learned a ton (thanks YouTube), had some great memories (see photo at top), and the end result turned out great for our needs.

At the end of the day, we turned our 5 bed 3 bath into a 6 bed 4 bath with two kitchens and a new basement entrance. It is basically two complete 3 bed 2 bath apartments stacked on top of each other.

How do we use the House?

Since it is basically just two 3bed/2bath apartments, we just split it down the middle: one floor for us, one floor for the guests.

On the main floor, my wife and I have the master bedroom and master bathroom, I use one of the other bedrooms as my home office (and closet, because my wife gets the full master closet of course), and, until recently, my wife’s sister was living in the 3rd bedroom with private access to the other bathroom on the floor (now the room is empty).

The main floor also has our nice new open floor plan where the kitchen and family room are located.

The basement is fully AirBnb. There are three bedrooms. One room — the master — has an ensuite bathroom. The other two bedrooms share the other bathroom. There is also a full kitchen and family room in the basement.

Finally, and my favorite part, there is a basement entrance with a keypad where each room has its own keycode that you can change directly from your phone at any time.

Let’s look at our 2020 earnings

Before we get into our returns (because that’s what really matters), we first need to look at our income.

We list each room for $30 per night and we target 100% occupancy. Therefore, we shoot for $900 per room per month, or $2,700 for the entire basement.

For context, renting a single bedroom long-term in our area is around $300 to $600 per month.

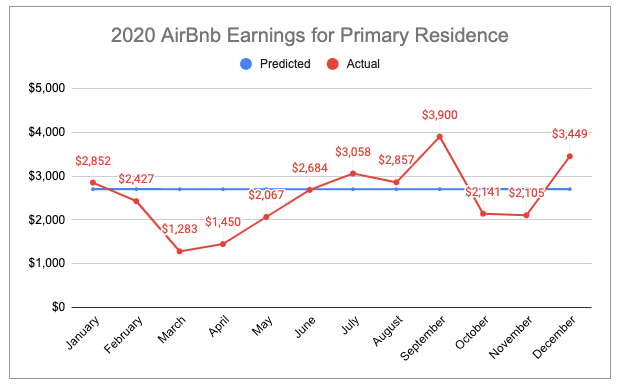

In the below visual, you will see a blue line which is set at $2,700 denoting our goal.

We can see that the year started strong where we were actually above our goal. In this instance, it was due to having a few reservations where there was more than one guest that stayed (the nightly rate goes from $30 to around $37 for having two guests vs one).

Then COVID enters the scene in March, but, surprisingly, it wasn’t that bad. Ultimately, our revenue only dropped a little over 50% to $1,283.

It stayed low in April at $1,450… bounced back strong in May to $2,067… and then was back to normal in June at $2,684 and has stayed strong ever since (note, all the peaks and valleys above and below the blue line after June are basically when someone booked for a long period of time but it got paid out the month prior, so one month is high and the other is low).

At the end of the day (well, the end of the year), our property averaged $2,523 per month, bringing in a total of $30,274.

Now let’s look at our 2020 returns.

$30,274, or any revenue figure for that matter, really means nothing if it isn’t used in comparison to what it cost you to generate that revenue.

We need to look at two things:

- How much of that $30,274 was actually profit (IE, we need to get rid of all the expenses)

- What did I have to commit financially to generate the profit

First, profit.

For simplicity, we will say profit is just your revenue minus your expenses. For even more simplicity, we will have a fixed monthly expense.

The house was bought in 2018 for $336,000 with 5% down and a 4.75% interest rate. At the end of 2019 we refinanced to 3.625% producing a monthly payment of about $1,750.

Other monthly house expenses are utilities ($250), internet ($60), and misc AirBnb supplies ($10).

So, our totally monthly expenses are $2,070, or $24,840 for the year.

Therefore, we profited $5,434 ($30,274 — $24,840).

Or did we…?

The complexities of “Total Value Gained”

The profit mentioned above is really just our annual cash flow. However, I like to look at a metric I call Total Value Gained (there is probably some fancy, official term for this, but I call it Total Value Gained).

Total Value Gained (TVG) is exactly what it sounds like: It is the total value you gained on your property for the year.

TVG is the sum of all your annual cash flow (the actual cash profit you made for the year… IE, the number we just calculated above) plus all the theoretical money you made. This theoretical money you made is the increase in equity you acquired throughout the year.

This increase in equity comes in two ways.

First, it comes every time your principal is paid down. Above, when we were calculating our cash flow, we subtracted our full mortgage payment. However, for my property, every time my mortgage is paid, about 30% of that payment, or $500, actually goes to my principal and thus increases my equity in the property.

Since AirBnbers are paying for this, that is value I am gaining, even though it won’t actually be realized until I sell or refinance the property.

So, if I am gaining about $500 in equity each month due to principal payments, I am gaining an additional $6,000 for the year.

The second way I gain value is simply through property appreciation.

The market is crazy where I live and properties have been skyrocketing year after year. If you own property, this is great. If you don’t, it’s really rough (this is why I have a love-hate relationship with all the Californians fleeing here…).

When we refinanced the house at the very end of 2019, our appraisal came back at $395,000. According to the internet machine, my house was worth $409,000 at the end of 2020 (which is about right).

Therefore, we made an additional $14,000 in theoretical value during the year.

Add all three of our numbers together ($5,424 in Cash, ~$6,000 in principal pay down, and $14,000 in property appreciation) and you get $25,434 in Total Value Gained for 2020.

But what did it COST us to make that?

If you want to calculate your return on investment, you first need to know what you invested and then you can figure out your return on that investment.

First off, when I’m in the middle of a longer term investment, I don’t care about my initial cash investment. That is 0% helpful for me at any specific moment in time. Read more about my grumpiness on that topic here.

What matters most is how much money you have committed at the beginning of the PERIOD IN QUESTION compared to what you have at the end.

Think about it. If you want to calculate how well your stocks did for the year, you don’t care what your portfolio value was 5 years ago. You care about how much your portfolio was worth at the beginning of the year compared to what it was at the end. The difference is your Total Value Gained and the starting portfolio value is what it cost you to gain that TVG. If it didn’t give you a good return then you should move that cash tied up in your portfolio somewhere else.

It is the same with your property.

At the end of the year, we made $25,434 in cash and theoretical value. However, how much cash (or equity) did we have stuck in the property that allowed us to make that $25K?

Easy. It’s the property value at the beginning of the year ($395,000) minus your total debt (mine was about $322,000). Therefore, I had $73,000 of value tied up in the property that I was hoping to get some return off of.

So, in a course of a year, my $73,000 (that I could have invested elsewhere) actually made me $25,434, giving me a return of 34.8%. This is your Return on Equity.

Obviously, we can break it down and look at the returns of each of the TVG components individually.

For example, if we look at just the cash flow of $5,434, we made a 7.4% return — still amazing.

Or how about the $6,000 of principal the AirBnbers paid for. That gives us an 8.2% return.

Finally, the $14,000 in appreciation is the final 19.2% return.

I prefer to look at the Total Value Gained when calculating my return on the equity, but if you feel like being ultra conservative, you can look at any of the three items that make up your Total Value Gained in isolation or together.

So there you have it…

In 2020, we grossed $30,274… this cashflowed us $5,434… and we gained an additional $20,000 in equity through property appreciation and principal paydown. This gave us an overall return of our beginning equity of $73,000 of 34.8%.

I like that return.

But technically there is one more thing…

Remember, we are also living in the property. So all our living expenses are also being paid for by this money coming in. One could argue that whatever my cost of living would be should also be added to the “Total Value Gained” metric.

So, if we said that an apartment plus utilities for a couple like my wife and me should be around $1,400 a month, then AirBnbing our property gave us an additional $16,800 in value.

This brings our TVG up to $42,234, and our Return on Equity to 57.9%.

So for me, in 2020, our property gave us a return of somewhere between 35 and 58%.

Not bad 2020, not bad.

Tell us your thoughts below or on our LinkedIn or Facebook posts.

If you’re interested in knowing how well your properties are doing at any given time, get the WayBoz app today!

Also, if you want to jump into the ever interesting world of short-term rentals, use this referral link and you’ll get a decent cash bonus when you host your first guest.